Level Funding

Best for Employers with less than 150 employee lives

Advantages

- Per employee, per month funding is easy to budget and easy to understand

- Specific and aggregate stop-loss coverage limits your plan’s exposure

- Monthly and quarterly reports provide full transparency on plan costs and performance

- 100% of the unused claims fund will be refunded at the end of the run-out period

Disadvantages

- Not good for poor performing companies

- The administrative fees may cut into the savings you hope to gain

- Some programs limit the amount of refund you can earn in a good year

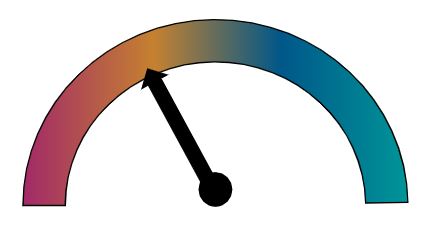

Small Risk

Little Reward

Employee Benefit Cooperatives/Captives

Best for Employers with 50 – 300 employee lives

Employee Benefit

Cooperatives/

Captives

Best for Employers with 50 – 300 employee lives

Advantages

- Stability of larger numbers

- Transparency in data and costs

- Accountability to participate in wellness and risk management programs

- Rewarded financially in good claim years

- Swim in a healthier pool

Disadvantages

- Members are expected to “play nice in the sandbox”

- Member engagement – calls and meetings

- Could be adversely impacted by the pool

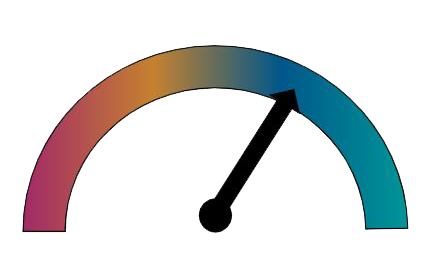

Medium Risk

Medium Reward

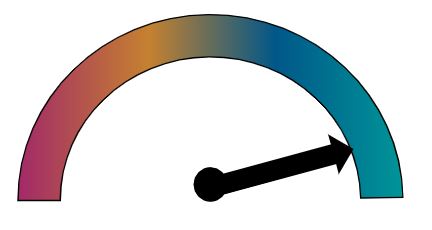

Self-Funding

Best for Employers with 250+ employee lives

Advantages

- Plan design flexibility

- Benefits from good performance

- Reward for investments into health, wellbeing and risk management

- Access to claims data and transparency in costs to your plan

Disadvantages

- Not always good for small to mid-size employers

- Fluctuation in claims can be a budget challenge

- Not good for employers with an unhealthy population